- A trillion-dollar valuation gap now separates Bitcoin from other tokens.

- Altcoin market capitalisation could be $800 billion higher, data shows.

- A US-China trade selloff erased $380 billion from crypto markets.

Bitcoin’s growing dominance in institutional portfolios has created a near-trillion-dollar gap between the world’s largest cryptocurrency and its altcoin peers, according to new data shared by 10x Research.

The report attributes this widening divide to a structural shift in investor behaviour, particularly among retail traders in South Korea, who have redirected funds from altcoins to crypto-linked equities and exchange-listed vehicles that hold tokens.

Retail shift weakens altcoin liquidity

10x Research found that altcoin market capitalisation could be about $800 billion higher if retail investors—especially in South Korea—had not channelled their funds into crypto-related stocks and other equity markets.

Altcoins, which typically rely on retail liquidity to sustain upward momentum, have failed to attract enough new capital in this cycle.

Historically, South Korean traders have been a major force behind the altcoin boom.

Local exchanges have seen altcoins account for more than 80% of total trading activity, a stark contrast to global platforms where Bitcoin and Ether dominate 50% or more of daily volume.

But that pattern has shifted sharply this year, leading to a liquidity shortfall for smaller digital assets.

South Korea’s trading activity declines

From 5 November through 28 November 2024, the daily average trading volume on South Korean crypto exchanges stood at $9.4 billion, surpassing the $7 billion traded on the Kospi stock market during the same period, according to data from CCData and the Korea Exchange.

However, since then, 10x Research noted a steep decline in crypto activity, suggesting that retail participation has cooled significantly.

The report highlights that South Korea’s declining appetite for riskier altcoins has been instrumental in their recent underperformance.

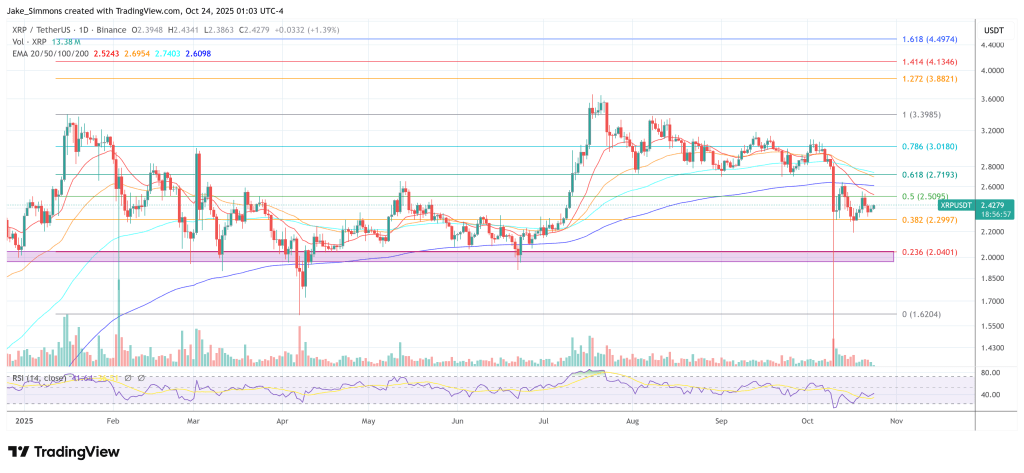

Retail investors who once drove speculative rallies in coins such as XRP, Cardano, and Solana have turned instead to listed blockchain firms and exchange-traded vehicles offering indirect crypto exposure.

This shift has contributed to the overall weakness in altcoin prices.

Market losses deepen amid trade tensions

A recent selloff in the broader cryptocurrency market, triggered by escalating US-China trade tensions, exacerbated the situation.

The correction wiped out about $380 billion from total market value, with roughly $131 billion concentrated in altcoins, according to 10x Research’s data.

While Bitcoin and altcoins both suffered declines, smaller coins bore the brunt as investors sought safety in the more established and liquid assets.

Bitcoin’s appeal as a hedge within the crypto ecosystem has strengthened, reinforcing its dominance during market stress.

The selloff underscores a changing market structure where altcoins are increasingly viewed as speculative instruments, while Bitcoin’s perceived institutional legitimacy provides it with greater resilience during downturns.

As capital concentrates around Bitcoin and select equities, the broader altcoin market faces challenges in regaining lost momentum.

The post Bitcoin’s institutional surge widens trillion-dollar gap with altcoins appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments